“`html

Bristol-Myers Squibb Co. (BMY), one of the largest pharmaceutical companies globally, is experiencing renewed growth momentum amidst historically low valuations in the healthcare sector. As of 2023, BMY’s stock is trading at about seven times forward earnings, which is one-third of the S&P 500’s multiple, while its revenue guidance has been raised from $46 billion to $47.75 billion and earnings per share guidance to $6.50.

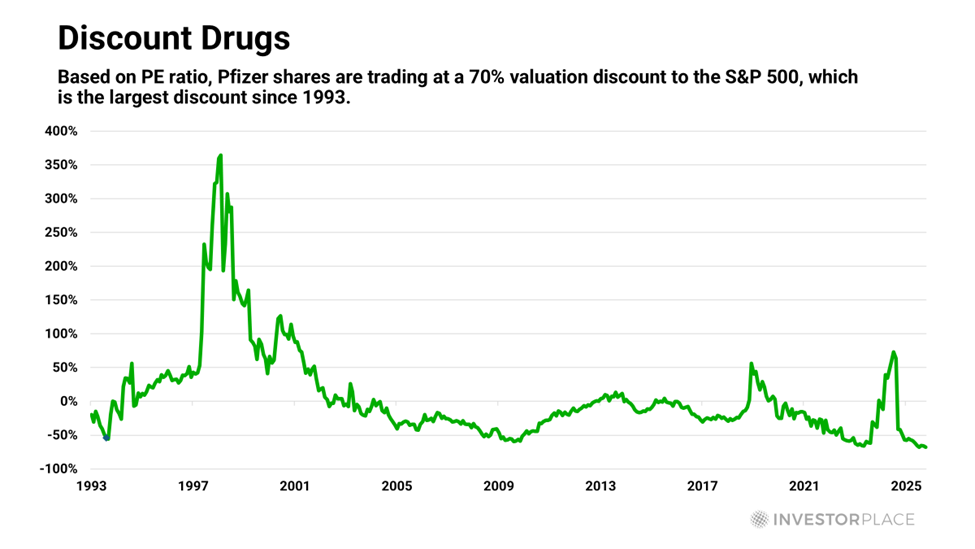

The healthcare sector is at a significant discount, with companies like Pfizer Inc. (PFE) showcasing a record-low 70% discount compared to the S&P 500, marking the largest gap since 1993. This creates a strong buying opportunity for investors seeking growth, particularly as the biopharmaceutical industry increasingly integrates AI technologies into drug development.

Currently, the healthcare sector offers a dividend yield of over 3%, which is more than double the S&P 500’s yield, indicating potential for robust long-term investment returns as cash flows rise and drug prices become more competitive.

“`