“`html

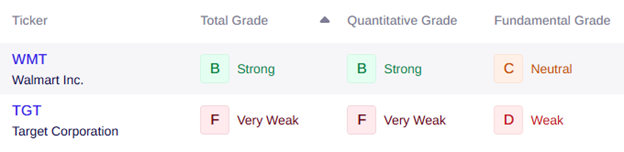

Walmart reported third-quarter earnings on Thursday, showing an earnings per share of $0.62, exceeding expectations of $0.60. Revenue increased by 6% year-over-year to $179.5 billion, surpassing projections of $177.6 billion. Notably, same-store sales rose by 4.5% and global online sales surged 27%, indicating strong performance across income levels.

In contrast, Target reported its third-quarter earnings on Wednesday, posting earnings per share of $1.78, slightly above the anticipated $1.72, while net revenue dropped 1.5% to $25.27 billion, falling short of the expected $25.32 billion. Target’s revenue has declined year-over-year for the past 12 quarters, prompting a revision of its full-year profit guidance from $7.75-$8.25 to $7.00-$7.50.

While Walmart raised its fiscal year sales guidance to a 4.8%-5.1% increase, Target maintains a cautious outlook, with management noting a shift in shopper focus towards essentials. This divergence strongly indicates that Walmart is better positioned to adapt in the current economic landscape.

“`