“`html

UiPath Inc. (PATH) reported second-quarter fiscal 2026 revenues of $362 million, a 14% year-over-year increase. The company holds $1.4 billion in cash and has no debt, allowing it to invest in innovation and expansion. Annual recurring revenues also rose 11% to $1.72 billion, bolstered by high customer retention rates of 108%.

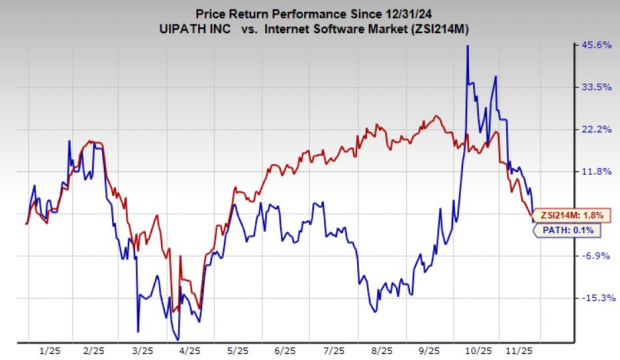

As of now, PATH shares have remained flat year-to-date and are down 15% over the past three months. Current market conditions suggest a cautious approach, with analysts recommending a “Hold” rating as the stock continues to consolidate amid strong momentum from its Agentic Automation suite and strategic alliances with major tech firms like Microsoft, Amazon, and Salesforce.

Looking forward, the Zacks Consensus Estimate forecasts third-quarter earnings of 14 cents per share, a 27% increase from the prior year. Revenue growth is projected at 11% this quarter, with further growth anticipated in subsequent fiscal years.

“`