“`html

AMD’s Recent Performance and Future Outlook

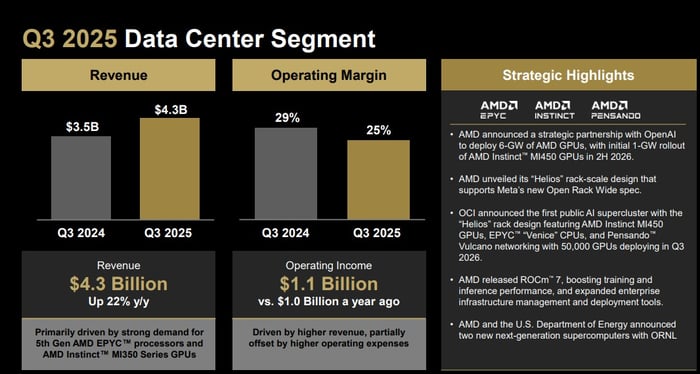

Advanced Micro Devices (AMD) reported its third-quarter earnings on November 4, 2025, showing a revenue of $4.3 billion attributed to its data center business, a 22% year-over-year growth. However, since the earnings report, AMD’s shares have declined by approximately 7.5%. Key concerns affecting the stock include macroeconomic uncertainties due to a U.S. government shutdown and challenges in penetrating the Chinese market, estimated by Nvidia’s CEO to be a $50 billion annual opportunity.

Additionally, AMD’s operating margin shrank by 400 basis points during the third quarter, sparking investor concerns over profitability compared to rivals like Nvidia. Despite the recent sell-off, AMD has seen a 91% increase in stock value throughout 2025. Looking forward, management aims to enhance revenue and profit margins through multi-year contracts, particularly with major clients like OpenAI, against a backdrop of anticipated $3 trillion to $4 trillion in AI infrastructure investments.

“`