“`html

Key Points

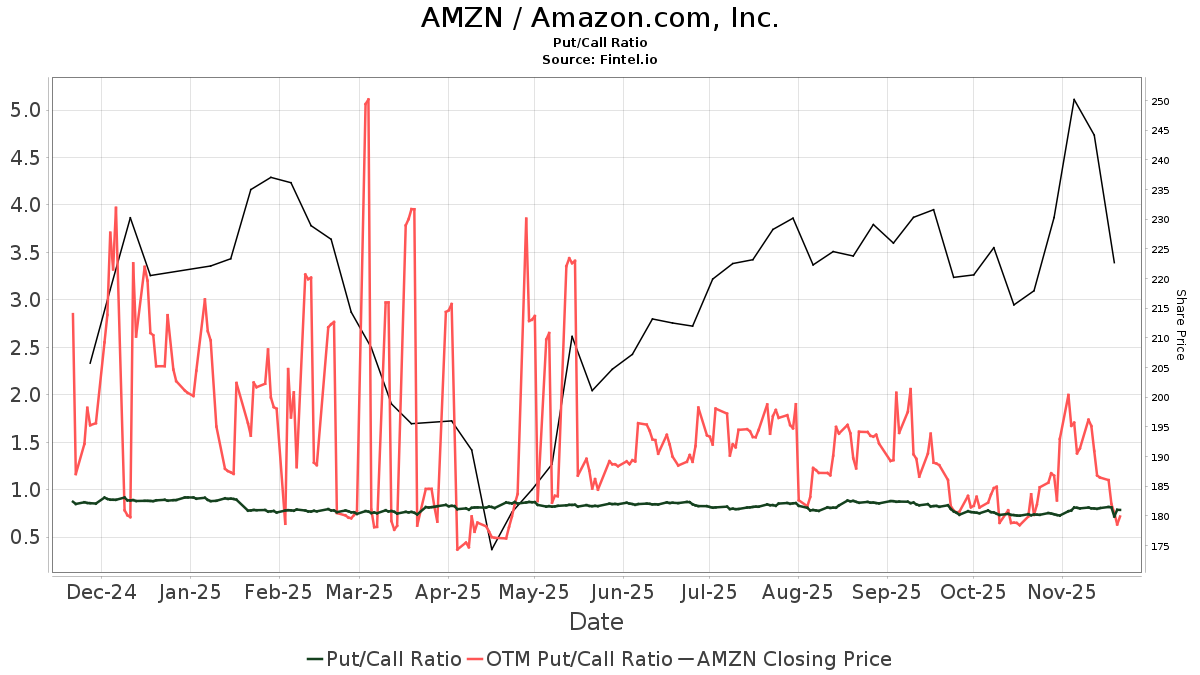

Billionaire investors are trending away from quantum computing stocks like IonQ and Rigetti Computing, despite significant gains of up to 1,490% over the past year. Instead, they are favoring Alphabet (NASDAQ: GOOGL), the parent company of Google and YouTube, which has been designated a top holding by several leading fund managers.

The deadline for institutional investors with over $100 million in assets to file Form 13F with the SEC was November 14. These filings indicate strong positions in Alphabet, which is the second-largest holding for Baupost Group and the third-largest for both Tiger Global Management and Pershing Square Capital Management. Notably, Warren Buffett’s Berkshire Hathaway purchased over $4 billion in Alphabet shares during Q3.

Despite the hype around quantum computing expected to generate between $450 billion to $850 billion in economic value in 15 years, historical trends suggest potential market bubbles. The trailing-12-month price-to-sales ratios for these quantum stocks range from 130 to as high as 2,661, indicating that key investors are mitigating risk by focusing on established companies like Alphabet that can leverage quantum technology without significant disruption to their existing businesses.

“`