“`html

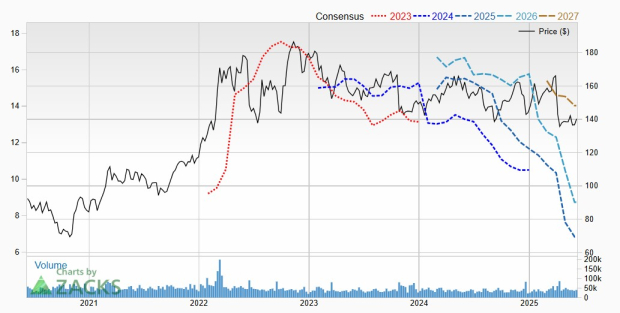

Chevron Corp. (CVX) is anticipated to experience a third consecutive year of declining earnings, with projections indicating a drop to $6.87 for 2025, down from $10.05 last year, reflecting a 31.6% decrease. The company’s earnings fell 30.3% in 2023 and another 23.5% in 2024, amidst depressed crude oil prices.

On May 2, 2025, Chevron reported first-quarter earnings of $2.18, surpassing the Zacks Consensus Estimate by $0.03. Worldwide production remained steady, experiencing minimal impact from asset sales, supported by growth in TCO (20%), the Permian Basin (12%), and the Gulf of America (7%). The company also returned $6.9 billion to shareholders through share repurchases and dividends during the quarter.

Chevron’s market capitalization stands at $244.9 billion, with a current dividend yield of 4.9%. Despite a year-to-date share price decline of only 4.4%, analysts are cautious, having downgraded earnings estimates, highlighting challenges in the oil market.

“`