“`html

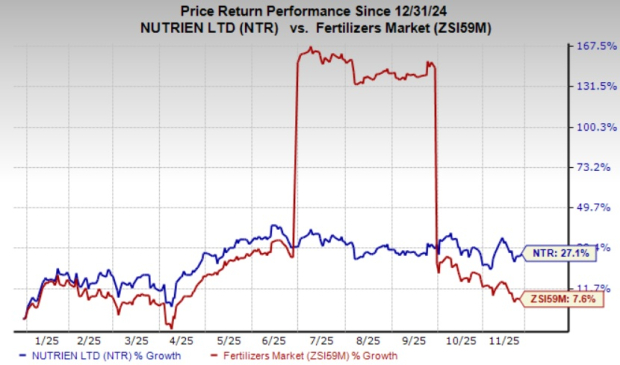

Nutrien Limited (NTR) reported a strong third-quarter performance for 2025, with retail adjusted EBITDA reaching $230 million, a 52% increase year over year. The company attributed this rise to cost-saving initiatives, including reduced operating expenses, which helped enhance profitability amid mixed market conditions. Over the first nine months of 2025, retail adjusted EBITDA totaled approximately $1.43 billion.

Nutrien has also trimmed its capital expenditures by 10%, down to $1.3 billion from $1.4 billion in the same period last year. The company anticipates achieving about $200 million in total cost savings by the end of 2025, significantly ahead of schedule.

In contrast, CF Industries Holdings, Inc. (CF) faced increased costs, with average natural gas prices climbing to $2.96 per MMBtu in Q3, compared to $2.10 a year earlier. The company experienced a 13% rise in selling, general, and administrative expenses in the same quarter.

“`