“`html

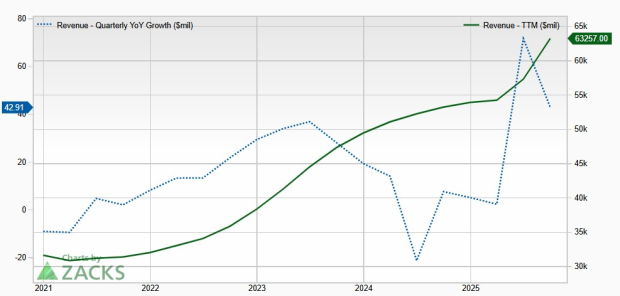

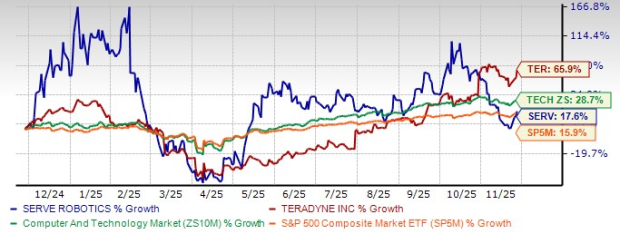

Capital One Financial Corporation (COF) has acquired Discover Financial for $35 billion in May 2025, making it the largest U.S. credit card issuer. This acquisition aims to enhance its payment network and expected cost synergies, with projected revenue growth rate of 35.6% for 2025 and 17.9% for 2026.

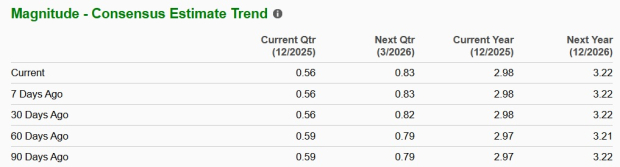

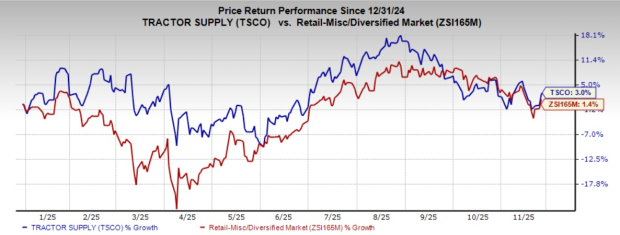

Synchrony Financial (SYF) has a robust liquidity position, holding $16.2 billion in cash as of September 30, 2025. However, its revenue estimates have been revised downward, with expected net revenues for 2025 between $15 and $15.1 billion, affected by higher Retailer Share Arrangements (RSAs) and lower loan receivables.

As of late 2025, Capital One has a net interest margin (NIM) of 6.88% and reported a consistent uptrend in key metrics, while Synchrony released a downward revision in its revenue forecast amid potential credit risks due to inflation and increased interest rates.

“`