“`html

NiSource Inc. (NI) is investing between $26.4 billion and $28.4 billion in capital expenditures for 2026-2030 to modernize infrastructure and replace coal-based units with clean energy. The company’s 2025 earnings per share (EPS) is estimated at $1.88, reflecting a year-over-year growth of 7.43%, while revenues are projected at $6.26 billion, representing a 14.70% growth.

NiSource has a current quarterly dividend of 28 cents per share, resulting in an annual yield of 2.56%, outperforming the S&P 500 average of 1.09%. The company’s total debt to capital stands at 58.37%, better than the industry average of 59.51%, indicating a more efficient capital structure.

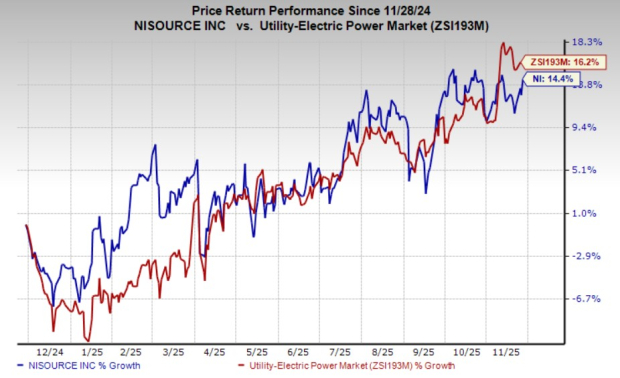

Over the past year, NI’s stock has increased by 14.4%, although it has underperformed the industry growth of 16.2%. NiSource’s earnings beat estimates in three of the last four quarters, achieving an average surprise of 3.23%.

“`