“`html

The dollar index (DXY00) decreased by 0.33%, hitting a 2-week low due to the yen’s strength following Bank of Japan (BOJ) Governor Ueda’s signal of a potential interest rate hike at the upcoming policy meeting. Concurrently, the November ISM manufacturing index dropped to 48.2, lower than the expected 49.0, adding bearish sentiment for the dollar. Moreover, the swaps market now prices a 100% chance of a 25 basis point rate cut at the Federal Open Market Committee (FOMC) meeting on December 9-10.

The dollar’s decline is compounded by reports suggesting Kevin Hassett, viewed as a dovish candidate, may succeed Jerome Powell as Fed Chair, which raises concerns over the Fed’s independence. Meanwhile, the euro increased by 0.32% against the dollar, bolstered by comments from ECB officials and the continuation of divergent monetary policies, whereas the yen rose to a 2-week high, reflecting safe-haven demand amid a slump in the Nikkei Stock Index.

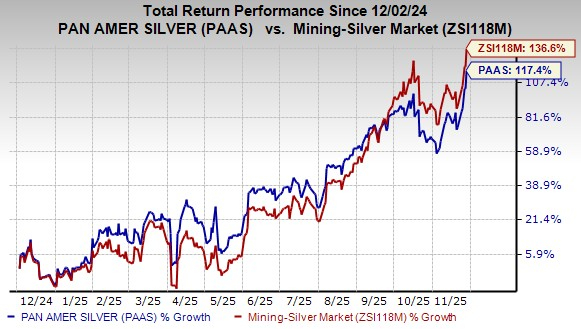

Japan’s Q3 capital spending rose by 2.9% year-over-year, below expectations of 6.0%, and the November S&P manufacturing PMI was adjusted down to 48.7. Upward pressure on precious metals was noted, as February gold rose to a 1.25-month high and silver reached a new all-time high at $57.80 per troy ounce, aided by the softer dollar and anticipated Fed rate cuts.

“`