“`html

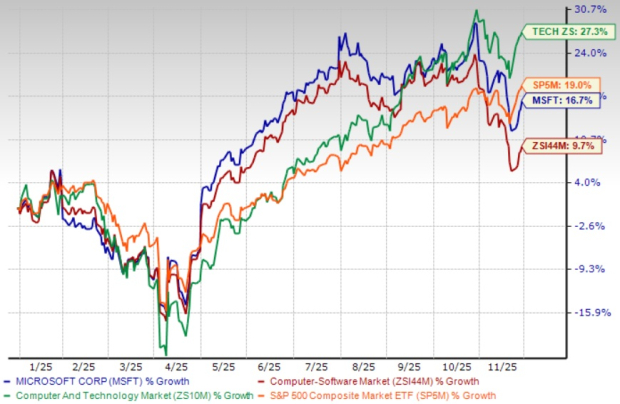

Microsoft (MSFT) has reported a year-to-date gain of 16.7%, outperforming the Zacks Computer-Software industry. A pivotal moment occurred in October 2025 when Microsoft and OpenAI announced a comprehensive restructuring of their partnership, wherein Microsoft maintains a 27% stake valued at $135 billion and exclusive intellectual property rights until 2032. This deal includes OpenAI’s commitment to purchase $250 billion worth of Azure services, enhancing Microsoft’s revenue visibility.

In its first fiscal quarter of 2026, Microsoft generated revenues of $77.7 billion, up 18% year-over-year, and operating income rose 24% to $38 billion. Azure and cloud services revenues increased by 40% in constant currency, significantly driven by AI demand. Furthermore, the Intelligent Cloud segment contributed $30.9 billion in revenues, a growth of 28% year-over-year.

Microsoft’s capital expenditures in Q1 FY2026 reached $34.9 billion, with half directed towards GPUs and CPUs for Azure. The company plans to increase AI capacity by over 80% in fiscal 2026 and aims to expand its data center footprint nearly double over two years. Despite concerns over near-term profitability impacted by a $3.1 billion loss from OpenAI investments, the Zacks Consensus Estimate for fiscal 2026 earnings stands at $15.61 per share, reflecting a 14.44% year-over-year growth.

“`