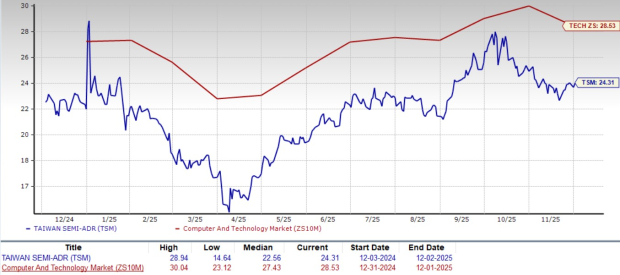

Taiwan Semiconductor Manufacturing Company (TSMC) is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 24.31, lower than the Zacks sector average of 28.53. Major competitors like Broadcom, Advanced Micro Devices, and NVIDIA have P/E ratios of 41.11, 26.36, and 27.26, respectively.

TSMC reported a revenue increase of 41% year-over-year, reaching $33.1 billion in Q3 2025, with earnings per share (EPS) rising 39% to $2.92. AI-related revenues are expected to double to account for a mid-teen percentage of total revenues in 2024, and the company plans to invest $40-$42 billion in capital expenditures in 2025 to support this growth.

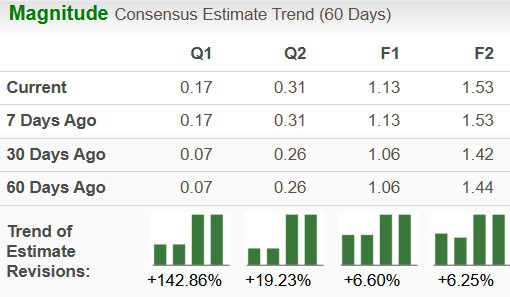

TSMC has increased its full-year revenue growth guidance to a mid-30% range for 2025, while the Zacks Consensus Estimate for fourth-quarter and full-year 2025 revenues stands at $32.6 billion and $120.47 billion, indicating year-over-year growth of 21.3% and 33.7%, respectively.