“`html

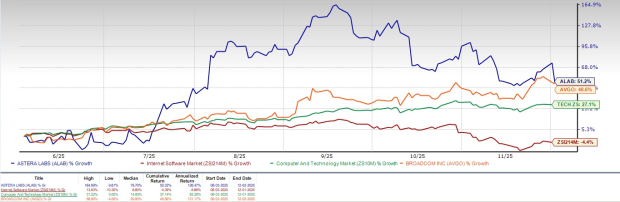

D-Wave Quantum (QBTS) reported a 167.8% increase in share price year-to-date as of the end of Q3 2025, significantly outperforming the S&P 500’s growth of 5.9%. The company is witnessing an accelerating demand for its annealing quantum platform, transitioning customers from exploratory proofs-of-concept to long-term commitments across various sectors, including logistics and financial services.

Despite rising revenues and a growing customer base, D-Wave faces challenges with high operating expenses leading to adjusted EBITDA losses. The company is focusing on enhancing its technology roadmap for next-generation systems, which are expected to support larger, more complex problems, while improving its hybrid solvers and API tools for enterprise adoption.

Currently, QBTS is trading below its 50-day moving average but above its 200-day average, indicating short-term weakness within a broader uptrend. Investors are advised to remain cautious due to the lack of operating leverage until margins stabilize and the stock regains momentum.

“`