“`html

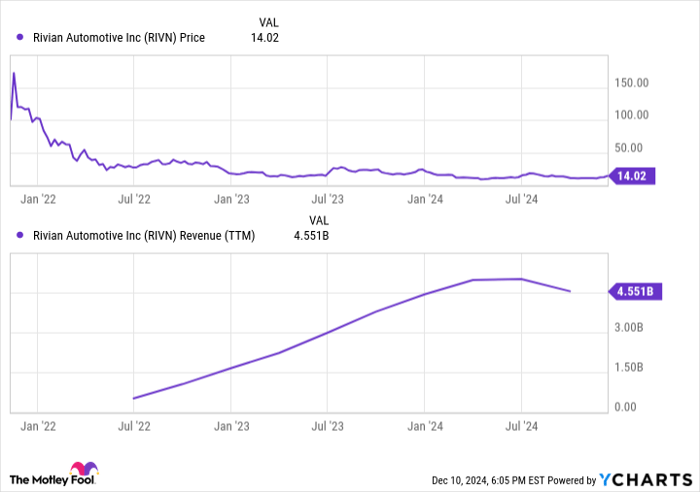

Lucid Motors (NASDAQ: LCID) reported a significant increase in vehicle deliveries, with 2,781 units delivered in Q3 2024, marking a 90% improvement from Q3 2023. In contrast, Tesla (NASDAQ: TSLA) delivered 462,890 vehicles during the same period. Despite this progress, Lucid is still far from achieving Tesla’s level of success.

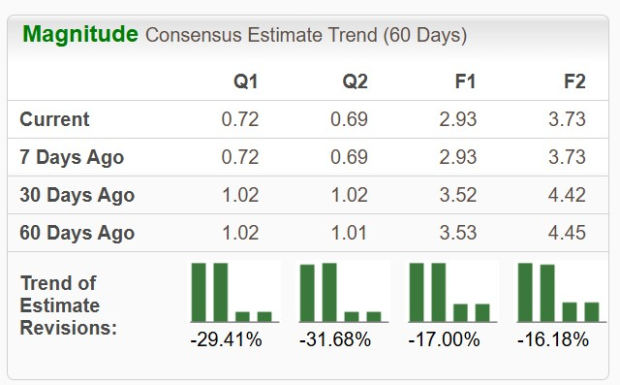

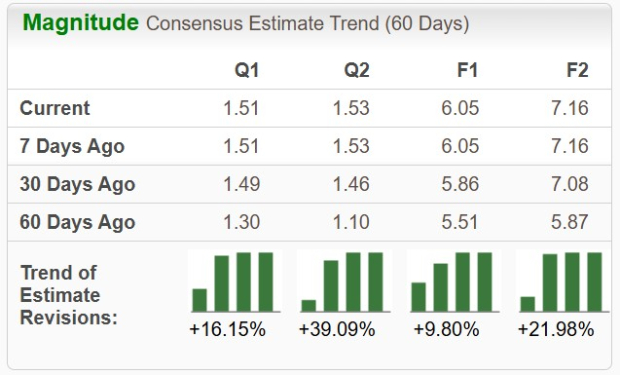

Financially, Lucid also noted a loss of $0.41 per share in Q3 2024, an increase from a loss of $0.28 per share the previous year, while Tesla earned $0.62 per share. Lucid ended the quarter with approximately $5.16 billion in total liquidity, indicating that while progress is being made, the company requires significant capital to build its business amidst intense competition.

“`