“`html

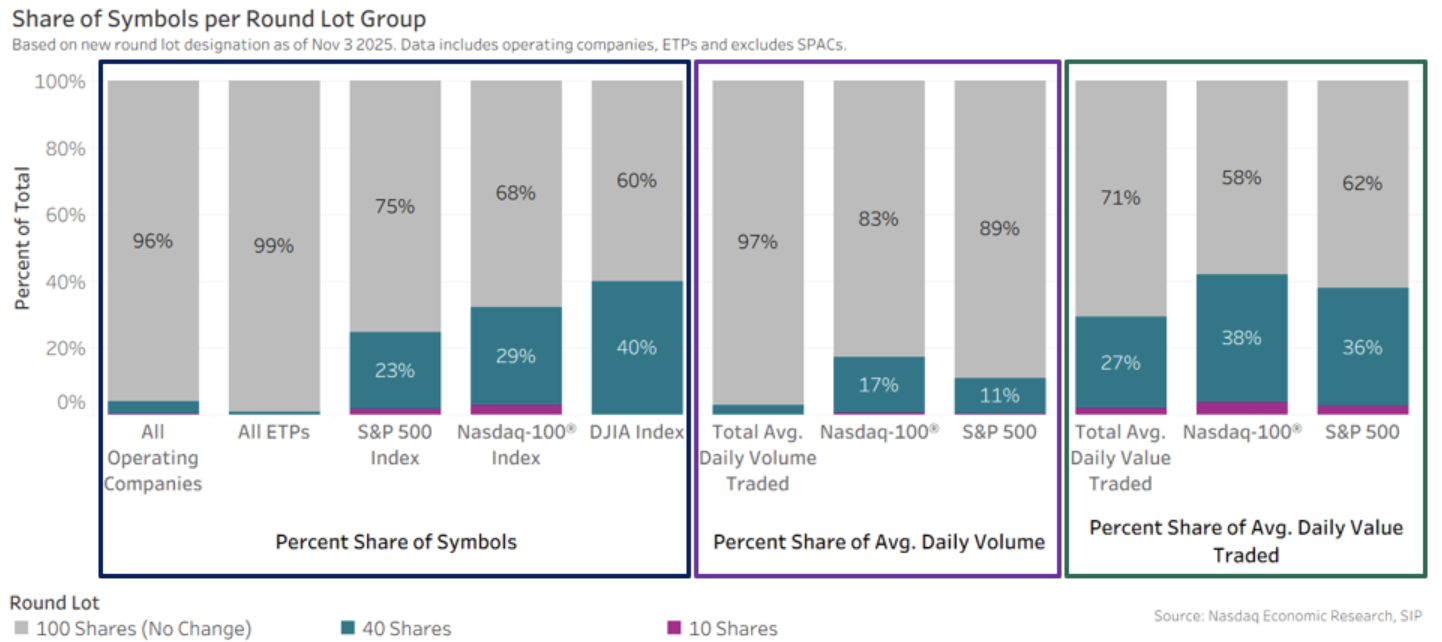

As of November 3, 2025, new Reg NMS round lots have been implemented for stocks priced over $250, affecting approximately 250 symbols, which represents only 3% of total listings. This includes 1% of exchange-traded products (ETPs) and 4% of corporate equities, yet these stocks account for 23% of S&P 500 constituents and 40% of Dow stocks.

The introduction of smaller round lots has significantly impacted trading, with average spreads decreasing by 50% for stocks with a 10-share round lot and 34% for those with a 40-share round lot. Overall, these changes have led to a reduction in the average daily value traded (ADVT) to 27% in affected stocks, benefiting both retail and institutional investors.

Furthermore, the cost of crossing the Nasdaq-100® basket has decreased, with the spread dropping from 5.5 basis points to 4.5 basis points, marking a 1 basis point reduction. The market has quickly adapted to these changes, with both spread and depth decreasing, thereby enhancing trading efficiency.

“`