“`html

Innodata Earnings Report Review

Innodata Inc. (NASDAQ: INOD) reported a 20% increase in revenue, totaling $62.6 million for Q3 2023, surpassing analyst expectations of $59.8 million. However, this marked a decline from previous growth levels, where revenue had doubled in the first half of the year. The company’s adjusted EBITDA reached $16.2 million, while GAAP net income totaled $8.3 million, or $0.24 per share.

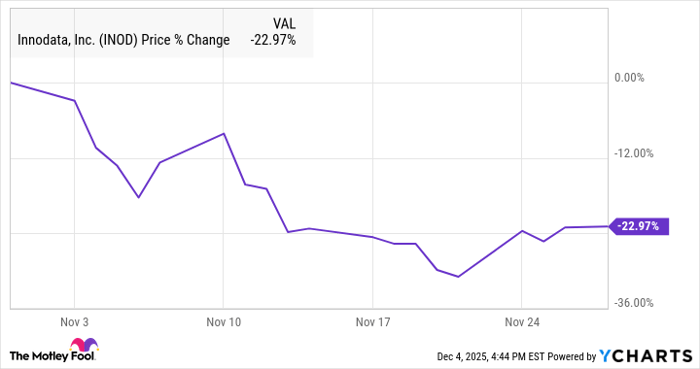

Despite good earnings, Innodata’s stock dropped 23% in September amid concerns about the AI sector’s stability and a broader market sell-off, with shares reacting negatively to an underwhelming earnings report. CEO Jack Abuhoff announced contracts worth up to $42 million in new business, but overall market sentiment remains shaky for smaller AI stocks.

“`