“`html

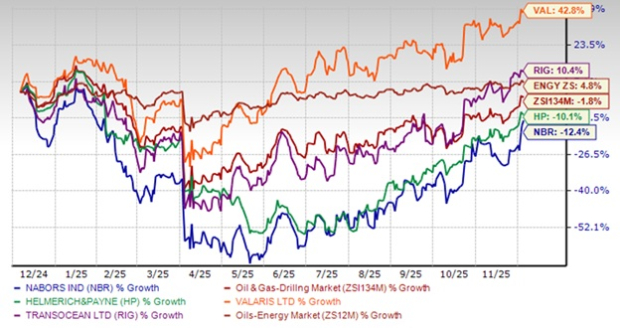

Nabors Industries Ltd. (NBR) has underperformed in the past year, with its shares declining by 12.4% while peers like Valaris (VAL) and Transocean (RIG) saw increases of 42.8% and 10.4%, respectively, as of the third quarter of 2025. In contrast, the Oil and Gas – Drilling sub-industry experienced a growth of 4.8%, along with the broader Oil and Energy sector rising by 5%.

Nabors’ adjusted EBITDA fell from $248 million in Q2 2025 to $236 million in Q3 2025, despite a recent high-margin divestiture. The company faces significant challenges, including declining rig counts in the U.S. Lower 48 market, heightened capital expenditures projected at $715-$725 million for 2025, and cash flow concerns due to underperformance in operations in Mexico, particularly with customer PEMEX. Management hints at a lack of operational momentum heading into Q4, with expectations of stagnation.

Furthermore, Nabors relies on non-recurring asset sales for debt reduction; its net debt has decreased to a decade low due to the sale of Quail Tools for $625 million. Future operational stability and cash flow generation remain uncertain, putting investor confidence at risk as the company is rated Zacks Rank #4 (Sell).

“`