“`html

Palantir and Nvidia: AI Stock Highlights

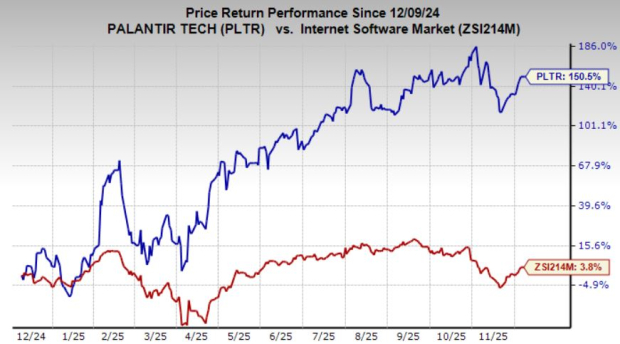

Palantir Technologies (NASDAQ: PLTR) and Nvidia (NASDAQ: NVDA) have both emerged as significant beneficiaries of the AI boom. As of Q3, Palantir reported a 63% revenue growth, with U.S. commercial revenue surging 121% and total U.S. commercial contract value increasing 342%. Palantir’s customer count rose by 45%, illustrating robust adoption of its AI platform, AIP, which is now being utilized across various industries.

Nvidia has dominated the AI infrastructure space, recording a nearly tenfold revenue increase over the last three years, reaching $57 billion after a 62% growth in Q3. The company continues to lead in GPU production, which is vital for AI workloads, and holds a substantial market position due to its software platforms like CUDA and NVLink.

Despite Palantir’s compelling growth metrics, Nvidia is favored for 2026 due to its reasonable valuation, trading at a forward price-to-earnings ratio of under 24.5, compared to Palantir’s 69 times projected revenue.

“`