“`html

EMCOR Group, Inc. (EME) reported a record $12.6 billion in Remaining Performance Obligations (RPOs), a 29% increase year-over-year. A significant portion of this growth (over 80%) is expected to come from the data center sector, which has seen mechanical and electrical construction revenues nearly double year-over-year. The company anticipates high-single-digit to low-double-digit organic growth in the long term, driven by a strong project pipeline and diverse market presence.

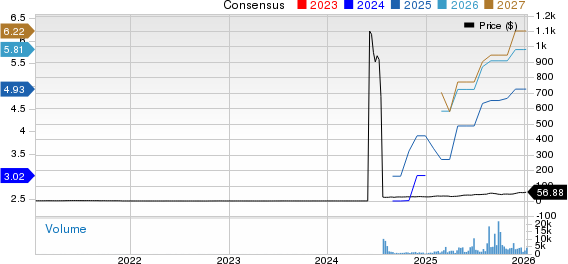

For 2025 and 2026, EMCOR’s earnings estimates have been revised upwards to $25.24 and $27.41 per share, reflecting year-over-year growth rates of 17.3% and 8.6%, respectively. Currently, EME stock has a forward price-to-earnings ratio of 22.86, positioning it at a premium compared to its industry peers.

EMCOR faces competition from major players like Fluor Corporation (FLR) and MasTec, Inc. (MTZ). Fluor focuses on complex energy projects, while MasTec emphasizes power delivery and renewable energy. EMCOR’s competitive edge lies in its broad service network enabling recurring revenues and its ability to efficiently execute projects across various sectors, including health care and industrial markets.

“`