“`html

The S&P 500 Index closed up by +0.67% on Wednesday, with the Dow Jones Industrial Average rising by +1.05% and the Nasdaq 100 increasing by +0.42%. This comes after the Federal Reserve cut interest rates by 25 basis points to a target range of 3.50%-3.75% in a 9-3 vote. Stocks were bolstered by the Fed raising its US 2025 GDP forecast to 1.7% and indicating plans to buy $40 billion of T-bills monthly to enhance market liquidity.

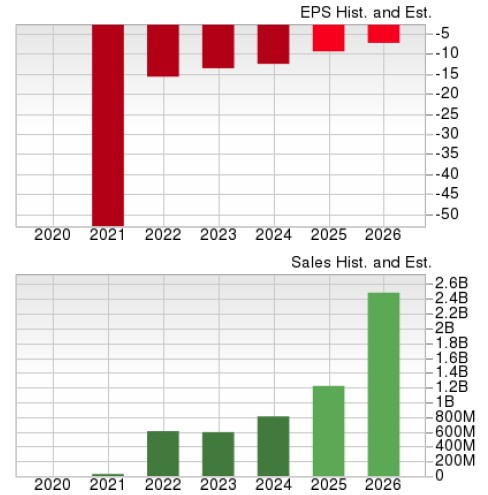

Additionally, the Q3 U.S. employment cost index rose by +0.8% quarter-over-quarter, slightly lower than the expected +0.9%. As for corporate earnings, 83% of S&P 500 companies exceeded forecasts, leading to a +14.6% rise in Q3 earnings, outperforming the +7.2% expected. The Fed’s updated dot plot shows a median forecast for the fed funds rate at 3.375% for the end of 2026, suggesting a possible rate cut next year.

In related news, US MBA mortgage applications rose +4.8% for the week ended December 5, while the average 30-year fixed mortgage rate increased by 1 basis point to 6.33%. Thursday’s market focus will be on initial unemployment claims, projected to rise by +29,000 to 220,000.

“`