“`html

Key Points

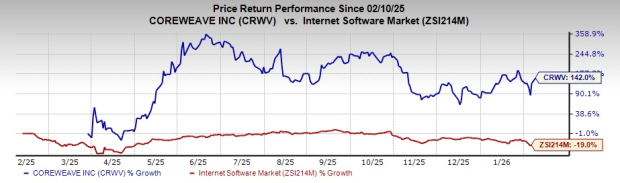

Investors are closely watching Nvidia and Palantir Technologies as artificial intelligence (AI) reshapes the tech landscape, contributing significantly to market gains in 2023. Nvidia has increased its market value by over $4 trillion this year, while Palantir’s shares have surged 2,700% since early 2020.

Despite their successes, insider trading activity raises concerns about future stock performance. Insiders have sold approximately $5.4 billion in Nvidia shares and $7.2 billion in Palantir shares since late 2020, totaling around $12.6 billion. Notably, no executives at Nvidia have bought company shares in the last five years, and only one insider purchase at Palantir has occurred since its public debut.

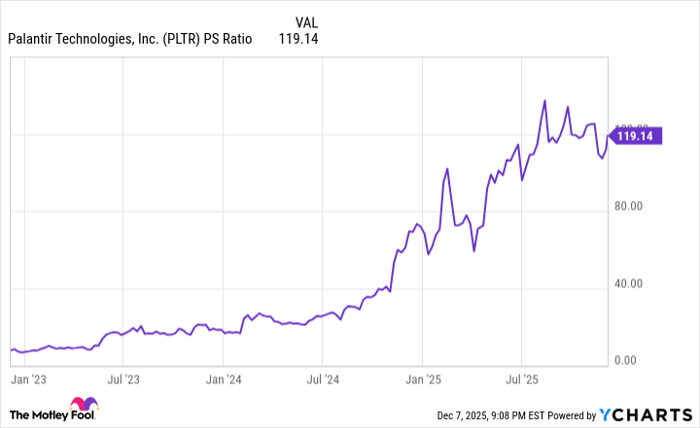

Currently, Nvidia’s price-to-sales (P/S) ratio exceeds 30, while Palantir’s is an astonishing 119, indicating potential overvaluation in an already expensive market. Historically, tech booms preceded busts, prompting concerns that the AI sector might face similar challenges by 2026.

“`