Tesla Q4 Sales Preview

Tesla (TSLA) is expected to announce its fourth-quarter sales figures in late January 2026, with analysts predicting delivery numbers around 450,000 to 455,000 vehicles. This comes after a record delivery of approximately 500,000 vehicles and production of around 447,000 in the previous quarter. However, November sales showed a significant decline, with approximately 40,000 vehicles sold, marking a 23% year-over-year drop.

Market Expectations and Context

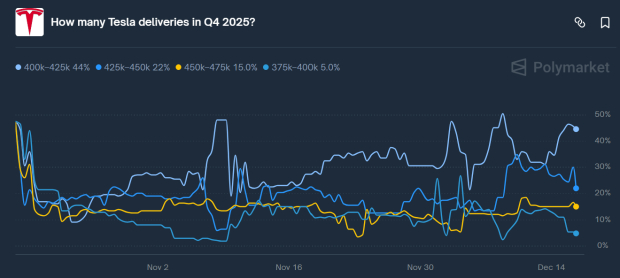

Consensus estimates from FactSet anticipate deliveries of around 450,000 units, while Bloomberg’s data suggests about 455,000. Polymarket betting markets indicate a 44% chance that Q4 sales could fall between 400,000 and 425,000. Factors contributing to the slowdown include a weakened brand image, reduced consumer sentiment, and increased competition from companies like BYD and Nio. Additionally, many consumers shifted their purchases to Q3 to capitalize on expiring EV tax credits.

Implications for Tesla

Despite the lower sales expectations, Tesla’s stock recently reached an all-time closing high, suggesting that the market may have already priced in a sales slowdown. Positive indicators such as improved brand metrics in the U.S. and strong performance of the Model Y in China could signal optimism for Tesla’s long-term growth prospects.