The average one-year price target for Worthington Steel (NYSE: WS) has been updated to $41.82 per share, reflecting a 13.89% increase from the previous estimate of $36.72 dated December 3, 2025. This new target represents a 15.11% rise from the latest reported closing price of $36.33 per share, with analyst projections ranging from a low of $41.41 to a high of $43.05.

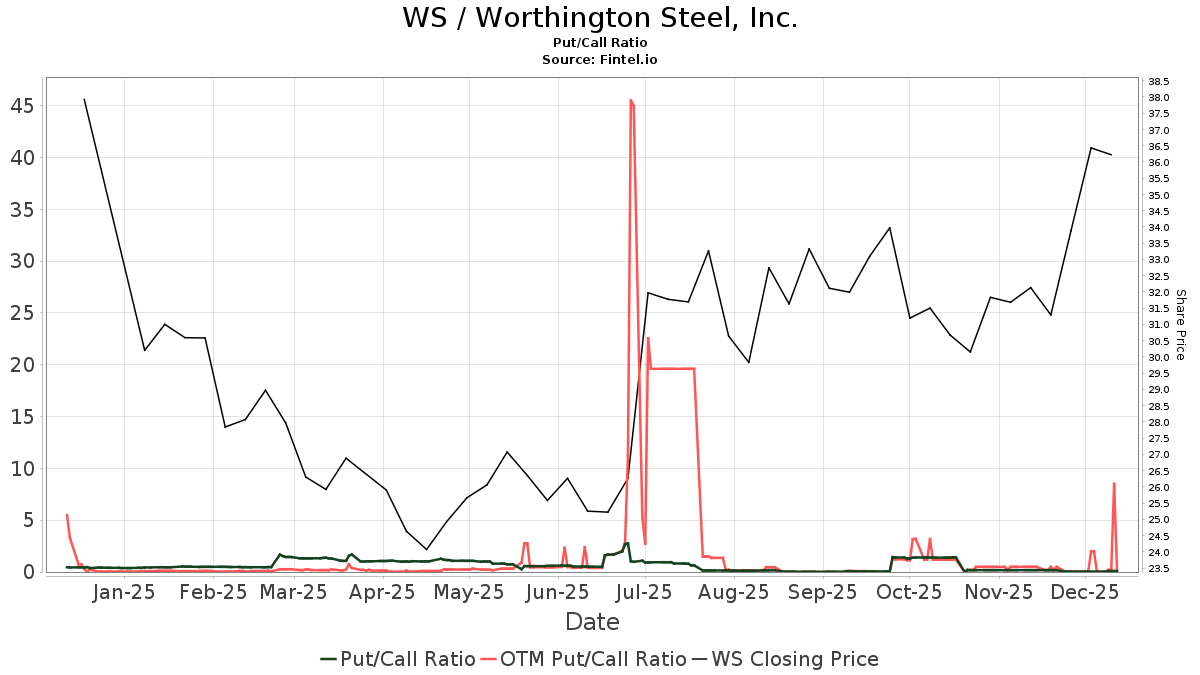

As of the last quarter, 462 funds or institutions report holding positions in Worthington Steel, a decline of 1.49%, while average portfolio weight dedicated to the stock rose by 0.92% to 0.08%. Total institutional shares owned increased by 3.25% to 34,047K shares. Notably, the put/call ratio for WS stands at 1.03, indicating a bearish outlook.

Significant shareholders include iShares Core S&P Small-Cap ETF with 2,086K shares (4.18% ownership), down 3.74%, and Vanguard Total Stock Market Index Fund with 1,231K shares (2.47% ownership), which increased by 3.36%. Alliancebernstein saw a substantial increase, now holding 970K shares (1.95% ownership) after growing its position by 545.96%.