U.S. stocks are approaching a rare milestone, potentially marking three consecutive winning years, yet investor sentiment remains filled with apprehension over factors like an AI bubble, persistent inflation, and uncertainties surrounding the Federal Reserve. The combination of a strong market alongside widespread anxiety has created favorable conditions for high-income investment opportunities in closed-end funds (CEFs), where market prices are falling while underlying portfolio values continue to grow.

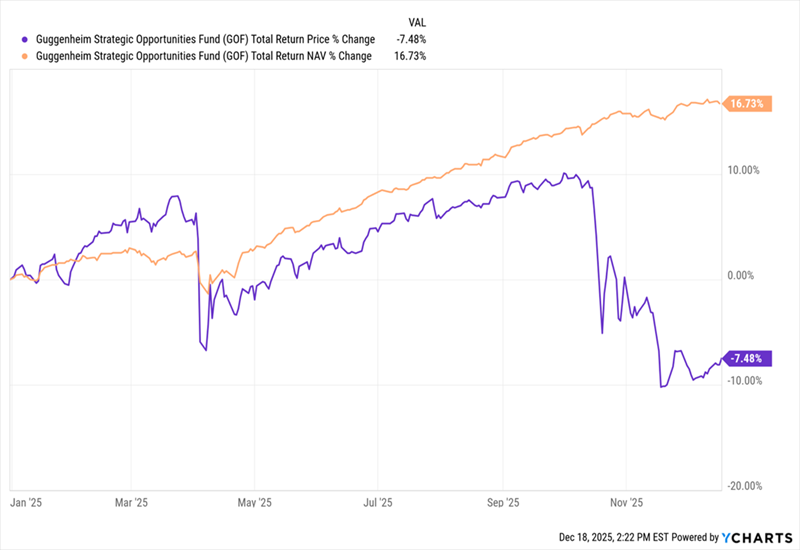

Key players in this landscape include the Guggenheim Strategic Opportunities Fund (GOF), yielding an extraordinary 17.9%, and currently trading at a premium despite its price drop. The Liberty All-Star Equity Fund (USA) has a 9.4% discount, its lowest in five years, alongside an 11% yield. Additionally, the Calamos Dynamic Convertible & Income Fund (CCD) offers an 11% yield, supported by a portfolio comprised of convertible and high-yield corporate bonds, though it also trades at a slight premium.

These trends suggest a significant disconnect between market prices and the actual value of these funds, prompting an opportune moment for investors to consider acquiring these CEFs as a means of capitalizing on the market’s current anxieties.