Newmont Corporation (NEM) and Kinross Gold Corporation (KGC) are leading gold mining companies experiencing significant capital movements and shifts in production. As of October 2025, gold prices have surged approximately 65% this year, with U.S. Federal Reserve interest rate cuts and increasing central bank purchases contributing to a bullish market. Notably, Newmont reported a 15% year-over-year production decline, reaching 1.42 million ounces in Q3 2025. The company anticipates maintaining production at around 5.9 million ounces for the year despite strategic divestments.

Meanwhile, Kinross boasts a robust production profile, particularly from its Tasiast and Paracatu assets. As of Q3 2025, Kinross reported a 66% increase in attributable free cash flow to $686.7 million, and it is currently poised for further production boosts from ongoing projects. Kinross’s liquidity stands at approximately $3.4 billion, enabling it to execute a significant share buyback program totaling $750 million this year, enhancing shareholder returns.

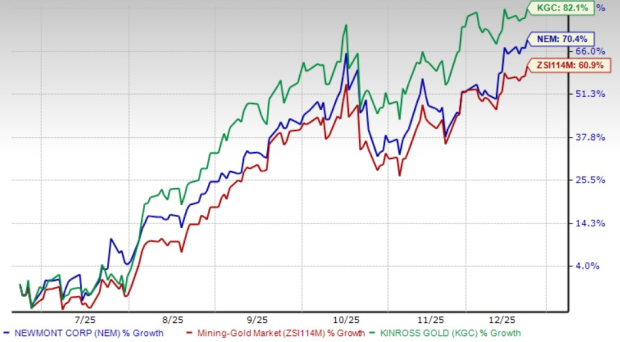

In terms of stock performance, NEM has increased by 70.4% over the past six months, while KGC has surged 82.1%, outperforming the industry average increase of 60.9%. Currently, Newmont bears a forward earnings multiple of 14.39, compared to Kinross’s 12.63, suggesting Kinross may provide a more attractive investment opportunity going forward.