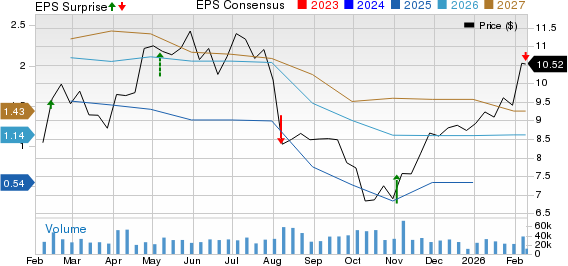

AI Stocks Pullback Amid Investor Concerns

Artificial intelligence (AI) stocks experienced a surge in interest from investors in recent years due to the technology’s transformative potential. However, recent fluctuations have raised concerns about the sustainability of this growth, prompting analysts to question whether certain stocks might be overvalued. The latest trends suggest a pullback in the AI sector, leading to increased caution among investors.

Key Players in AI

Nvidia (NASDAQ: NVDA) remains a frontrunner as a leading designer of AI chips, supported by strong relationships with major clients like Amazon and Meta. Amazon (NASDAQ: AMZN) has reported an annual revenue run rate of over $132 billion for its AI-focused cloud segment, Amazon Web Services (AWS). Apple (NASDAQ: AAPL), having recently entered the AI space, is viewed as having significant growth potential with its evolving AI features.

Market Context

As of the latest evaluations, AI stocks face scrutiny regarding their valuations amidst fears of a potential market correction. Investors are advised to focus on stocks with established financial stability and growth trajectories to maximize long-term returns in the AI space.