As the U.S. government approaches 2026, it faces escalating debt challenges, with significant emphasis on reducing interest payments on its federal debt. Current strategies include leveraging stablecoins, digital dollars pegged to the value of the dollar, aimed at boosting demand for U.S. Treasuries.

On July 20, 2023, President Trump signed the GENIUS Act, establishing the first federal framework for payment stablecoins. Visa (V) recently launched stablecoin settlements in the U.S., achieving a monthly settlement volume of $3.5 billion as of November 30, 2023. This advancing infrastructure positions Visa to benefit as stablecoins gain traction, allowing for faster transactions without traditional fees.

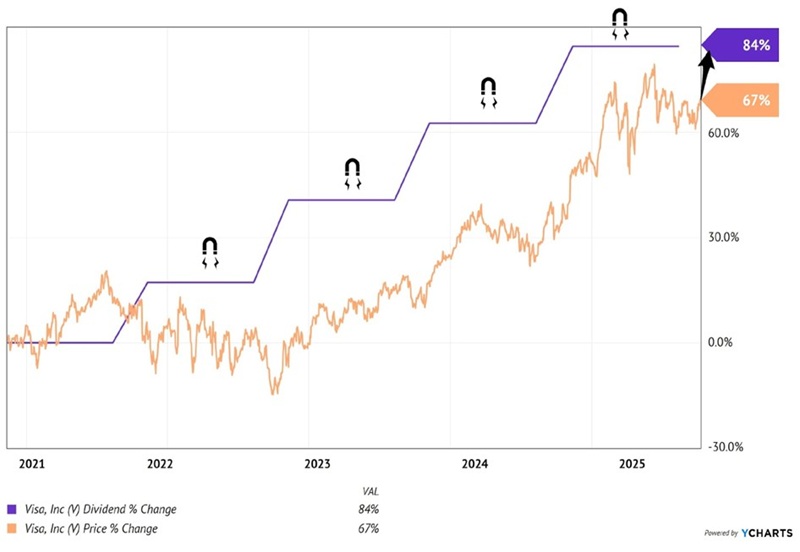

Visa’s strategies include the introduction of its Global Stablecoins Advisory Practice and partnerships for transactions using USD Coin. The company continues to demonstrate financial strength, minting over $20 billion in annual free cash flow with a history of dividend increases, including a recent 13.6% raise. This positioning is expected to enhance investor returns, particularly as the digital dollar ecosystem expands.