Nike’s Struggles and Future Prospects

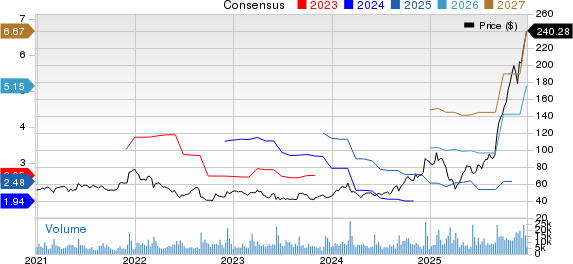

Nike Inc. (NYSE: NKE) has experienced a significant downturn, losing approximately 65% of its value since the beginning of 2022, following a 29.8% drop in 2022, 7.2% in 2023, and 30.3% in 2024. The stock is currently down 22.4% year-to-date. Key challenges include weak performance in the Chinese market and declining consumer spending in North America. As a result, investors are shifting expectations from growth to a potential turnaround, with a focus on gradual signs of improvement rather than strong quarterly results.

Nike’s recent strategy, termed “Win Now,” emphasizes a return to core competencies such as running and basketball, while scaling back on overexpansion. This shift aims to stabilize the business after facing significant margin compression and challenges in the direct-to-consumer segment. Following a disappointing earnings report where management forecasted a slight revenue decline for the upcoming quarter, Nike’s shares fell by 10.5%.

Long-term investors may consider maintaining their positions or purchasing shares, which currently offer a 2.7% dividend yield. However, the path to recovery will depend on improvements in profitability and effective execution of Nike’s new strategies as the company navigates a challenging market landscape.