Adobe Inc. (ADBE) reported a significant increase in annual recurring revenues (ARR), reaching $25.2 billion for fiscal 2025, up 11.5% year-over-year, with expectations to rise to $25.6 billion by the end of fiscal 2026. This growth is attributed to strategic partnerships with major tech companies such as Amazon Web Services (AWS), Microsoft Azure, and OpenAI, alongside the launch of Adobe Premiere Mobile in Q4 2025.

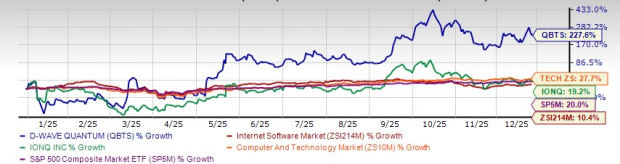

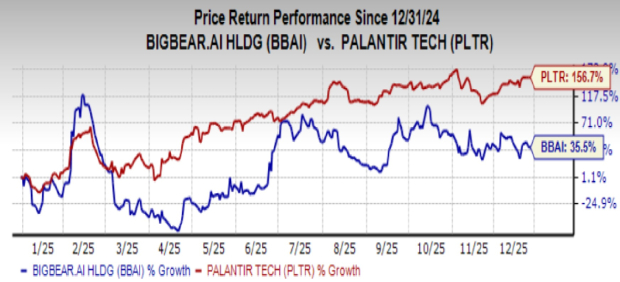

Despite these advancements, Adobe’s stock has declined 21.6% over the past year, underperforming compared to the broader Zacks Computer and Technology sector, which gained 22.9%. In contrast, competitors like Microsoft and Alphabet are experiencing significant success in AI integration, with Microsoft reporting 900 million monthly active users of AI features and Alphabet’s AI offerings driving 75 million daily active users.

The Zacks Consensus Estimate for Adobe’s first-quarter 2026 revenues stands at $6.28 billion, reflecting a growth of 9.89% from the same period last year. Earnings per share are projected at $5.86, indicating a 15.4% growth year-over-year.