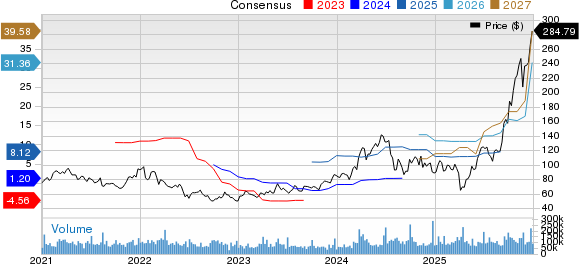

Nvidia (NASDAQ: NVDA) is projected to achieve a Q3 revenue of $57 billion in 2025, marking a 62% increase year-over-year and 22% quarter-over-quarter. In contrast, Palantir Technologies (NASDAQ: PLTR) reported a Q3 revenue of $1.18 billion, up 63% year-over-year and 18% quarter-over-quarter. While Palantir’s stock is forecasted to finish 2025 up more than 150%, Nvidia is deemed a better investment due to its more attractive valuation, with a price-to-earnings-to-growth (PEG) ratio of 0.72 compared to Palantir’s 3.0.

As of now, Nvidia’s forward price-to-earnings ratio stands at 24.8, while Palantir’s is significantly higher at 192.3. Both companies have similar growth trajectories, but Nvidia’s lower valuation presents a better risk-reward proposition amid speculation surrounding future AI infrastructure demand. Investors are cautioned that while Nvidia faces potential risks from competitors, Palantir’s valuation poses a more immediate concern.