**Semiconductor Stocks Surge Amid Market Challenges**

In 2025, semiconductor stocks have rallied significantly, with the iShares Semiconductor ETF (SOXX) showing a 43% increase year-to-date. This growth is attributed to rising demand driven by increased investments in artificial intelligence (AI) and high-performance computing. The World Semiconductor Trade Statistics report forecasts global semiconductor sales to reach $975.4 billion in 2026, a 26.3% increase year-over-year, with AI accelerators and advanced logic chips expected to be key growth drivers.

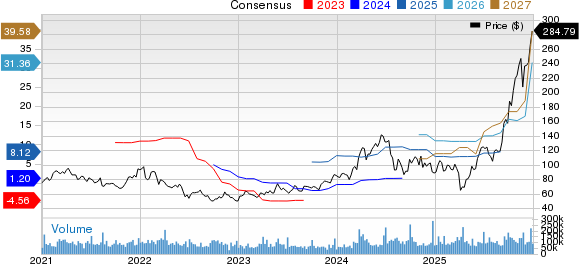

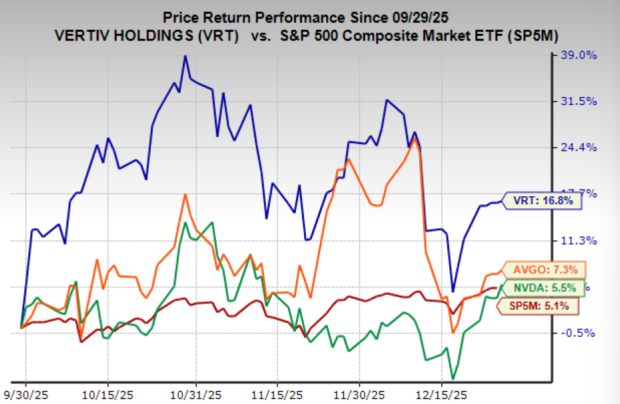

Key players like NVIDIA Corporation (NVDA), Micron Technology (MU), and Amphenol Corporation (APH) are well-positioned to benefit from this trend. Analysts predict NVIDIA’s revenues will grow by 62.4% for fiscal 2026, while Micron’s revenues are estimated to rise by 89.3% in the same year, amidst a recovery in the memory market. Amphenol is projected to see a 49.4% revenue increase for 2025 and a 12.4% rise in 2026, driven by demand in AI data centers and automotive applications.