Roku reported that its fourth-quarter 2025 platform revenues are projected to reach $1.12 billion, reflecting a 14.5% year-over-year growth. The revenue streams consist of advertising on the Roku platform and The Roku Channel, as well as streaming service distribution revenue from premium subscriptions and transaction fees.

Key drivers of Roku’s growth include an expansion in demand-side platform integrations, with nearly 90% of advertisers using Ads Manager being new to Roku, indicating a shift toward smaller businesses. The platform’s advertisements outpace the overall U.S. OTT and digital advertisement markets, further enhancing revenue potential. Additionally, Roku plans to enhance its content lineup in 2026 with original programming and partnerships to bolster engagement.

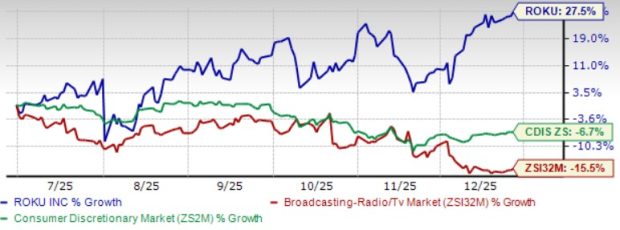

Roku’s share price has increased by 27.5% in the past six months, significantly outperforming the broader market, while the company carries a forward Price/Sales ratio of 3.11X compared to the industry average of 4.3X. The Zacks Consensus Estimate expects Roku to report an earnings per share of 28 cents, a recovery from the previous year’s loss of 24 cents per share.