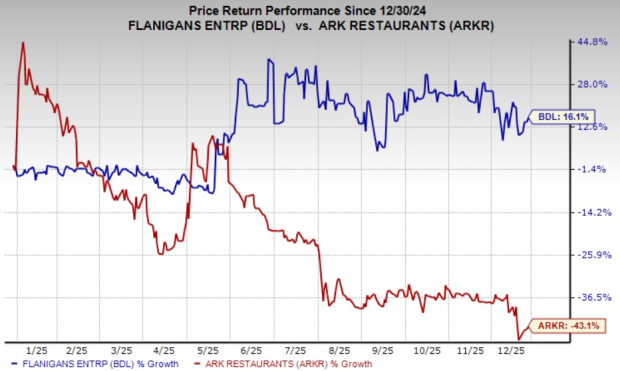

Aerospace and defense manufacturers CPI Aerostructures, Inc. (CVU) and SIFCO Industries, Inc. (SIF) are navigating a challenging market influenced by fluctuating funding and rising costs. CVU focuses on complex structural assemblies for military aircraft, while SIF specializes in forgings and machined components for various sectors, including aerospace. As of recent performance, CVU has experienced a 52.8% gain over three months, whereas SIF saw a decline of 22.9%. In the last year, SIF increased by 52.3%, while CVU’s value dropped by 5%.

SIF’s stock is supported by stronger demand in the military and commercial aerospace sectors, alongside ongoing margin improvement efforts. Its operating discipline, focusing on cost control and selective price increases, has contributed to enhanced profitability. Conversely, CVU benefits from exposure to long-duration defense programs, serving as both a prime contractor and Tier 1 supplier. This positioning invites steady contracted work but comes with execution risks associated with program cancellations and cost management challenges.

Currently, SIF’s valuation appears more attractive, trading at a trailing enterprise value-to-sales ratio of 0.37X compared to CVU’s 0.89X. Given SIF’s improving market conditions and CVU’s elevated valuation, analysts suggest that SIF may present a more favorable investment opportunity within the aerospace supply chain.