Key Points

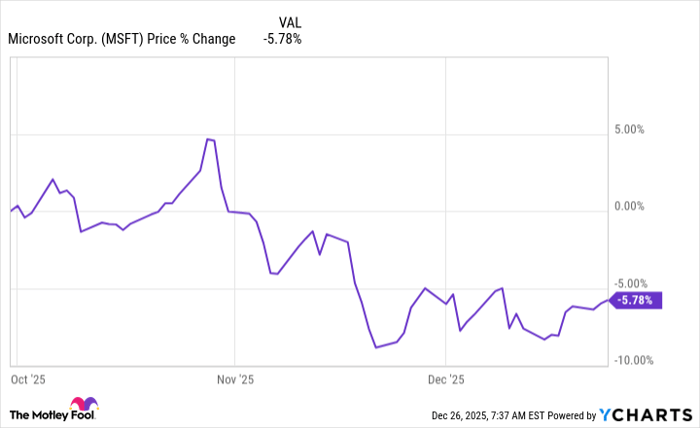

As of September 30, 2025, billionaire Chase Coleman, through Tiger Global Management, reported no trades in four of his five largest holdings, indicating a long-term investment strategy. His portfolio includes 10.5% in Microsoft (NASDAQ: MSFT), which has seen significant demand in the AI sector.

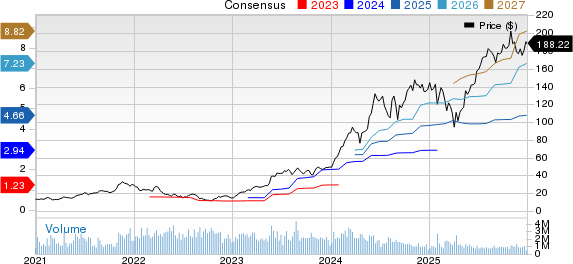

Microsoft’s Azure platform experienced 40% revenue growth in Q1 FY 2026, making it the fastest-growing cloud service among major providers. Analysts project revenue growth of 16% for FY 2026 and 15% for FY 2027, although the stock trades at a premium of 30 times forward earnings.

Despite facing potential questions regarding the usefulness of its AI products, Microsoft’s investment thesis remains strong, with Wall Street’s expectations for steady revenue growth. Should growth slow, however, Microsoft’s stock may struggle in the coming years.