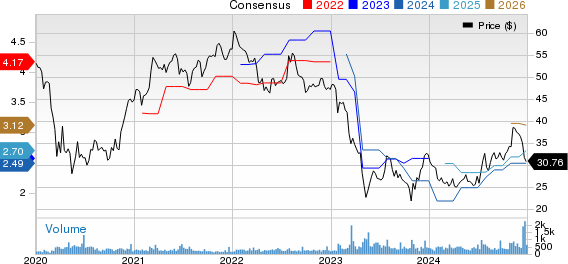

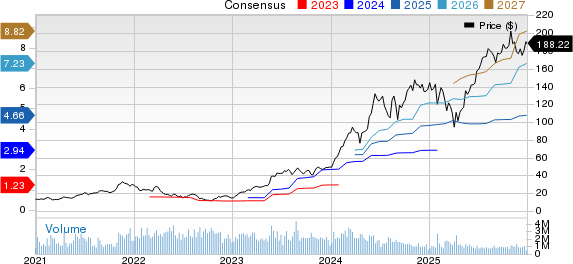

Stratus Properties Inc. (STRS) has seen its shares rise by 31.3% over the past six months, significantly outperforming the real estate operations industry, which grew by only 12%. Notably, the company’s key competitors, CBRE Group, Inc. (CBRE) and Brookfield Corporation (BN), recorded 16% and 13.1% increases, respectively. This performance is largely attributed to successful asset sales, strong liquidity, and high demand for development projects in Texas markets.

Based in Austin, TX, Stratus specializes in the entitlement, development, and management of residential and retail properties. The company has reported a notable liquidity boost of $55 million and significant cash proceeds from property sales, including $26.9 million from Lantana Place and $7.8 million from West Killeen Market. However, Stratus is also managing challenges such as elevated construction costs and a reported loss of $9.6 million in its real estate operations for the first nine months of 2025.

Despite facing cost pressures, Stratus maintains a robust development pipeline, controlling approximately 1,500 acres of land with ongoing projects like Holden Hills and The Saint George. However, its valuation currently stands at 10.9X trailing EV/sales, notably higher than the industry average of 3.75X and relative peers CBRE (1.31X) and Brookfield (4.27X).