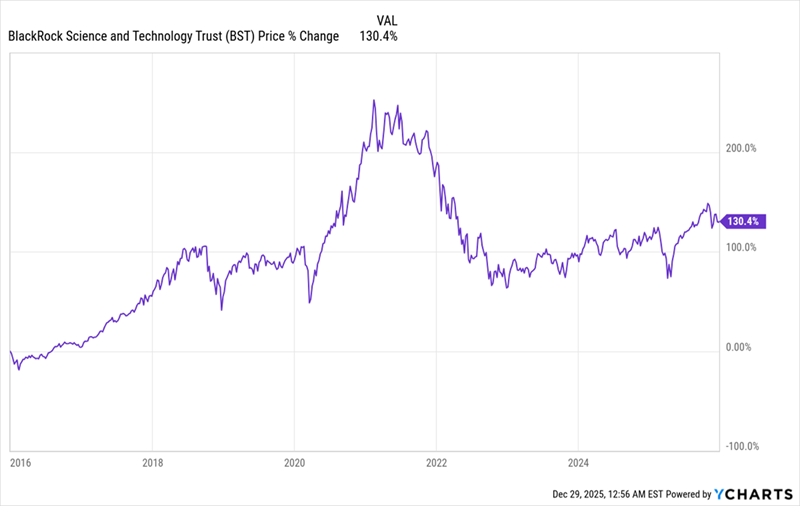

Investors in closed-end funds (CEFs), such as the BlackRock Science and Technology Trust (BST), may overlook significant income opportunities due to reliance on free stock screeners that report only market-price returns. As of now, BST has achieved a market price increase of 130.4% over the last decade, but its total return, which includes dividends, stands at an impressive 408.5%. This exemplary performance demonstrates the critical importance of considering total returns when evaluating high-yielding investments.

In financial terms, an investment of $10,000 in BST made in 2016 would yield profits of $40,850 when including total returns, significantly surpassing the $13,040 indicated by market-price returns alone. The average yield of CEFs tracked by CEF Insider is currently 8.9%, compared to just 1.1% for the S&P 500, underscoring the potential benefits of dividend-focused investment strategies.