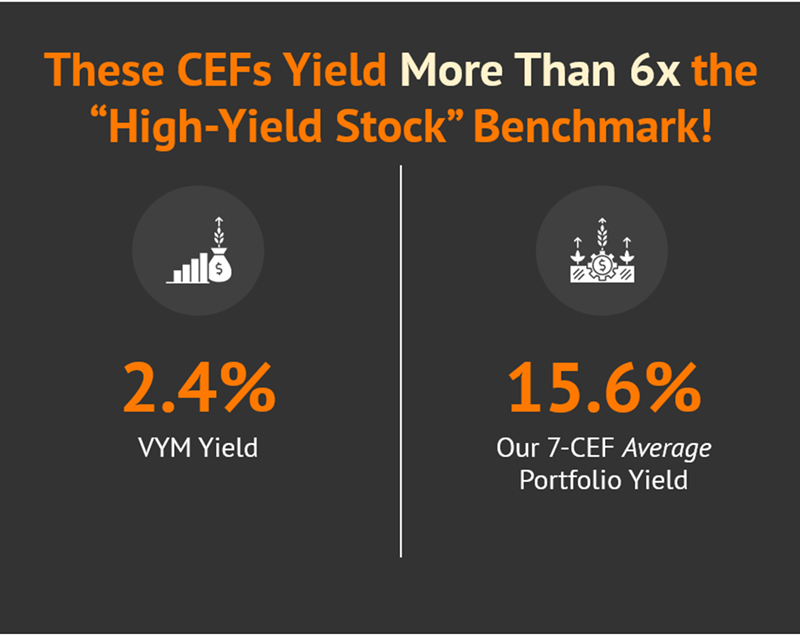

Investors are advised to explore closed-end funds (CEFs) for potentially higher retirement income, with yields ranging from 9% to 33.5%, unlike traditional exchange-traded funds (ETFs) that typically yield only 1% to 2%. For instance, a $500,000 investment in these funds could generate annual income of up to $78,000.

Key examples include BlackRock’s Core Bond Fund (BHK) with a 9.3% distribution rate and BlackRock’s Multi-Sector Income Trust (BIT) at 11.3%. Additionally, CEFs like Oxford Lane (OXLC) boast a significantly high 33.5% yield, although it carries inherent investment risks. The India Fund (IFN) offers a 16.1% yield and is currently priced at a nearly 8% discount to its net asset value (NAV).

As CEFs generally trade below NAV and utilize leverage for better returns, investors should exercise caution and perform thorough research before purchasing, ensuring they are identifying genuine yield opportunities rather than yield traps.