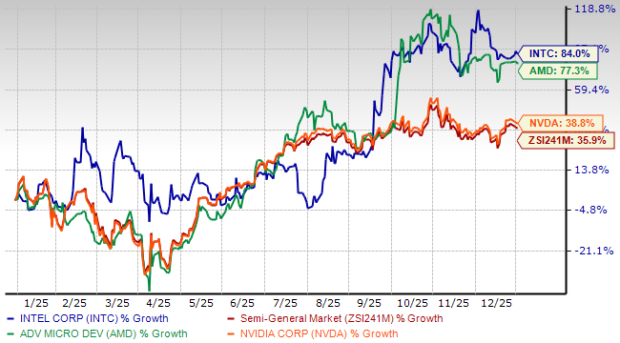

Intel Corporation (INTC) experienced an impressive 84.1% stock price increase in 2025, outperforming competitors like Advanced Micro Devices, Inc. (AMD) and NVIDIA Corporation (NVDA) with growth rates of 77.3% and 38.8%, respectively. The company’s turnaround was particularly notable following a lackluster performance in the first half of the year.

Key developments for Intel include the upcoming launch of its Intel Core Ultra series 3 processor and Xeon 6+ processor, set for January and early 2026, respectively. These products will be manufactured at a new facility in Chandler, AZ, and are designed to enhance AI capabilities across consumer and enterprise markets. Additionally, Intel secured a $5 billion investment from NVIDIA and a $2 billion investment from Softbank aimed at boosting AI research, which marks a significant collaboration for developing advanced technology infrastructure.

However, challenges persist as Intel faces declining earnings estimates with a 63% reduction to 34 cents for 2025. Factors affecting growth include competition from domestic chipmakers in China, which accounted for over 29% of Intel’s total revenues in 2024, and an evolving market landscape necessitating a transition away from legacy products. The company is now contending with heightened price sensitivity and changing consumer demands, which impact its margins and overall profitability.