U.S. stocks are positioned for a potential January rally despite recent declines, primarily influenced by the seasonality known as the “January Effect” and motivated by year-end reinvestments. In 2025, major indexes saw significant gains, even following an April sell-off driven by President Trump’s tariff declarations.

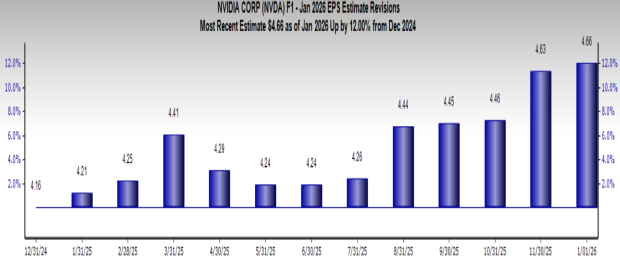

Key players in the technology sector, notably NVIDIA Corporation, Micron Technology, Inc., and Palantir Technologies Inc., are projected to capitalize on renewed buying momentum. NVIDIA anticipates fiscal fourth-quarter revenues of approximately $65 billion and a 55.9% earnings growth rate for the current year. Micron projects revenues between $18.3 billion and $19.1 billion for Q2 of fiscal 2026, with an extraordinary growth rate of 278.3%. Palantir expects total revenues of $4.396 billion to $4.400 billion for 2025, demonstrating a growth rate of 42.5%.

Additionally, NVIDIA’s growth is bolstered by demand for AI hardware and easing U.S.-China trade tensions. Micron’s high-bandwidth memory chips continue to drive demand, while Palantir’s AI Platform gains traction among various clients, indicating a strong outlook for 2026 in the AI-driven market.