Alibaba Group Holding Limited (BABA) is facing significant cash flow challenges as its expansion strategy in AI and cloud services strains its financials. In the September quarter, the company reported a substantial decrease in operating cash flow and a negative free cash flow outflow, attributed to approximately RMB120 billion spent on capital expenditures over the past year. Despite strong revenue growth in cloud and AI services, the rapid expansion into quick commerce is increasing costs and pressure on margins.

In contrast, rivals like JD.com and PDD Holdings are managing cash flow pressures more effectively. JD.com reported solid revenue growth and improved retail margins in Q3 2025, leveraging its self-owned logistics system, while PDD Holdings maintained strong operating cash flow and cost efficiency with an asset-light model. Alibaba’s long-term success hinges on AI and quick commerce transforming into profitable ventures, yet the current outlook suggests only a modest 5.75% revenue growth for fiscal 2026 coupled with heightened execution risks.

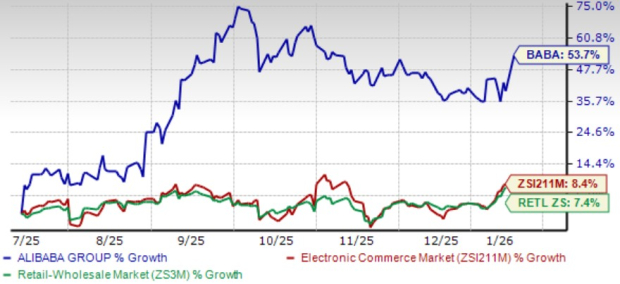

Alibaba’s stock has increased by 53.7% over the past six months, contrasting with the 8.4% and 7.4% growth of the Zacks Internet – Commerce and Retail-Wholesale sectors, respectively. The Zacks Consensus Estimate for fiscal 2026 earnings stands at $6.42 per share, marking a year-over-year decline of 28.8% and reflecting the company’s current challenges.