JPMorgan Chase & Co. (JPM) and Delta Air Lines (DAL) reported strong Q4 earnings on Tuesday, exceeding analysts’ expectations but experiencing stock declines of over 2% due to cautious economic outlooks. JPMorgan posted Q4 sales of $45.79 billion, a 7% increase from $42.76 billion the previous year, driven by a 17% rise in market revenue. Delta reported Q4 sales of $16 billion, up 3%, despite a 2% revenue hit from a government shutdown.

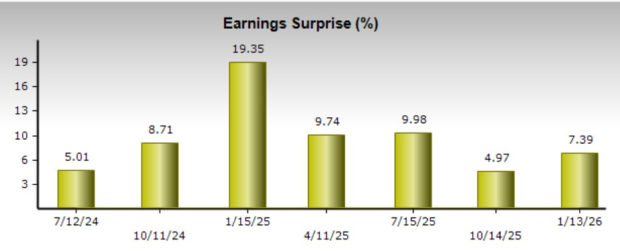

JPMorgan’s net income reached $13 billion with an adjusted EPS of $5.23, surpassing expectations by 7%. Delta’s net income was $1.22 billion, translating to an adjusted EPS of $1.55, slightly beating estimates by 1%. For the fiscal year, JPMorgan’s sales increased by 3% to $185.6 billion, while Delta’s sales rose 2% to a record $63.4 billion.

JPMorgan expects FY26 net interest income of $103 billion, while Delta anticipates FY26 EPS growth of 20% or more, projecting EPS between $6.50 and $7.50. Both companies are aiming to navigate current economic uncertainties while maintaining solid financial performance.