Royal Caribbean Cruises Ltd. (RCL) reported strong financial performance in the third quarter of 2025, with net yields remaining above historical levels, attributed to high close-in demand and increased onboard spending. The company’s management noted that the strength of close-in bookings allowed RCL to achieve premium pricing without early discounting, leading to net yield growth that surpassed expectations.

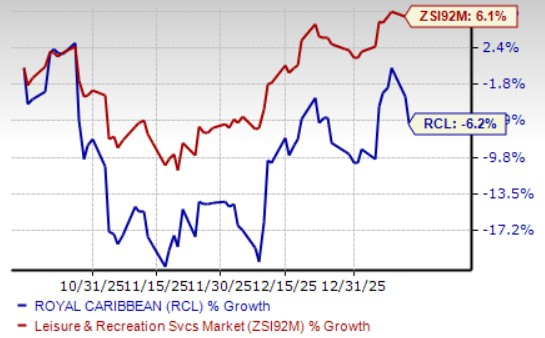

RCL’s adjusted EBITDA margin expanded despite fluctuations in fuel and operating costs, as a shift towards higher-margin pre-cruise purchases enhanced revenue visibility. Looking forward, the company expressed confidence in sustaining elevated yield levels into 2026, supported by robust booking trends and a focus on premium products. However, RCL shares have seen a decline of 6.2% over the past three months, contrasting with an industry growth rate of 6.1%.

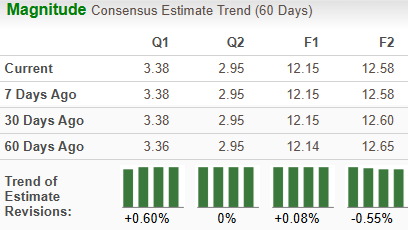

Additionally, RCL trades at a forward price-to-earnings ratio of 16.26, which is below the industry average of 17.76, while the Zacks Consensus Estimate projects a 14.1% increase in RCL’s earnings for 2026, although EPS estimates have declined in the last month.