Nvidia Growth Forecast for 2026

Nvidia (NASDAQ: NVDA), the world’s largest company by market capitalization, is set to achieve a projected 50% revenue growth for the fiscal year ending January 2027. This surge is driven by increased AI spending and the launch of its new architecture, Rubin. Analysts anticipate another robust year of growth for the company, further solidifying its dominance in the graphics processing unit (GPU) market, particularly in artificial intelligence applications.

MercadoLibre’s Stock Opportunity

MercadoLibre (NASDAQ: MELI), often deemed the “Amazon of Latin America,” is currently down nearly 20% from its all-time high, offering a rare buying opportunity for investors. The company has established a strong presence in e-commerce and fintech within Latin America, positioning it to benefit from digital payment infrastructure growth, which is critical for the region’s economic development.

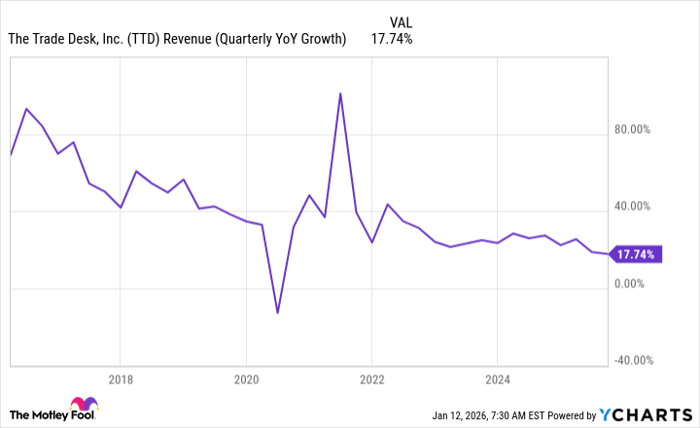

The Trade Desk’s Recovery Path

The Trade Desk (NASDAQ: TTD) is bouncing back from a challenging 2025, achieving 18% revenue growth despite setbacks with its AI-driven ad platform. The company boasts a customer retention rate of 95% in Q3, indicating strong loyalty among its clients. At a valuation of 18 times forward earnings, which is comparatively lower than the S&P 500’s 22.4, The Trade Desk presents a compelling investment opportunity as it seeks to regain momentum in 2026.