Investment Strategies for Young Investors

This holiday season, a gift strategy was introduced by an author aimed at teaching financial literacy to young family members aged 11 to 16. Instead of traditional gifts, recipients were offered cash with an added incentive: 1.5 times the amount if they opened and funded an investment account. As of January, two out of three have opted for the investment route.

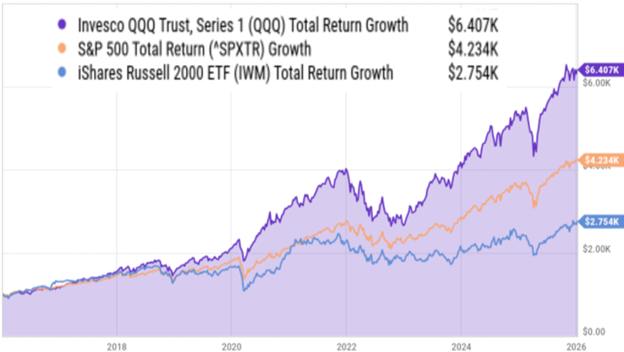

Key insights reflect that time spent in the market is critical for positive investment outcomes. According to Yardeni Research, the likelihood of achieving a positive return on U.S. equities increases significantly over time, with chances reaching nearly 95% over a decade. Historical data shows that a $1,000 investment in the Nasdaq-100 Index in early 2016 could grow to approximately $6,500 by early 2026, highlighting the impact of both time and choice of asset.

Furthermore, the options market is seeing substantial growth, with Nasdaq-100 options volumes increasing by 50% in 2025 alone. This trend is attributed to a younger investor demographic that places value on sophisticated investment tools, enabling them to engage actively with the market rather than remain passive.