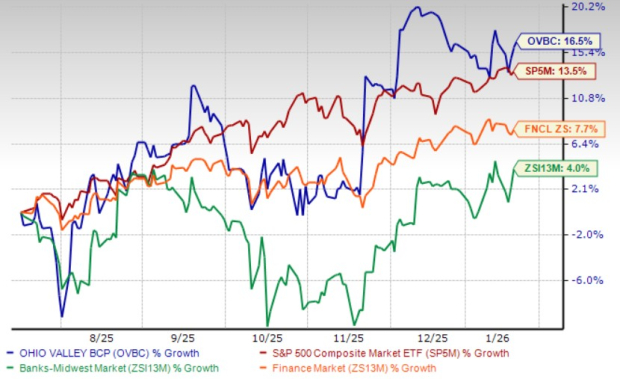

Ohio Valley Banc Corp. (OVBC), based in Gallipolis, OH, reported a 16.5% stock increase over the past six months, outperforming both the banking industry (4%) and the S&P 500 (13.5%). This growth aligns with the company’s improved third-quarter 2025 results released in October 2025, showcasing a significant boost in profitability driven by increased net interest income and margin expansion.

Key metrics include the company’s trailing 12-month P/E of 13.4X, above the industry average of 11.9X and its five-year median of 9.9X. OVBC continues to focus on relationship-based lending, emphasizing commercial and real estate loans while effectively managing its balance sheet to support loan growth and financial stability in a competitive banking environment.

Despite these positive developments, challenges remain due to OVBC’s concentrated geographic presence and competitive pressures, which could impact future performance in loan demand and asset quality. Investors may find OVBC’s current valuation somewhat high in relation to operational improvements, suggesting careful consideration is warranted for new entrants amid ongoing market fluctuations.