Nvidia’s Latest Developments and Performance Insights

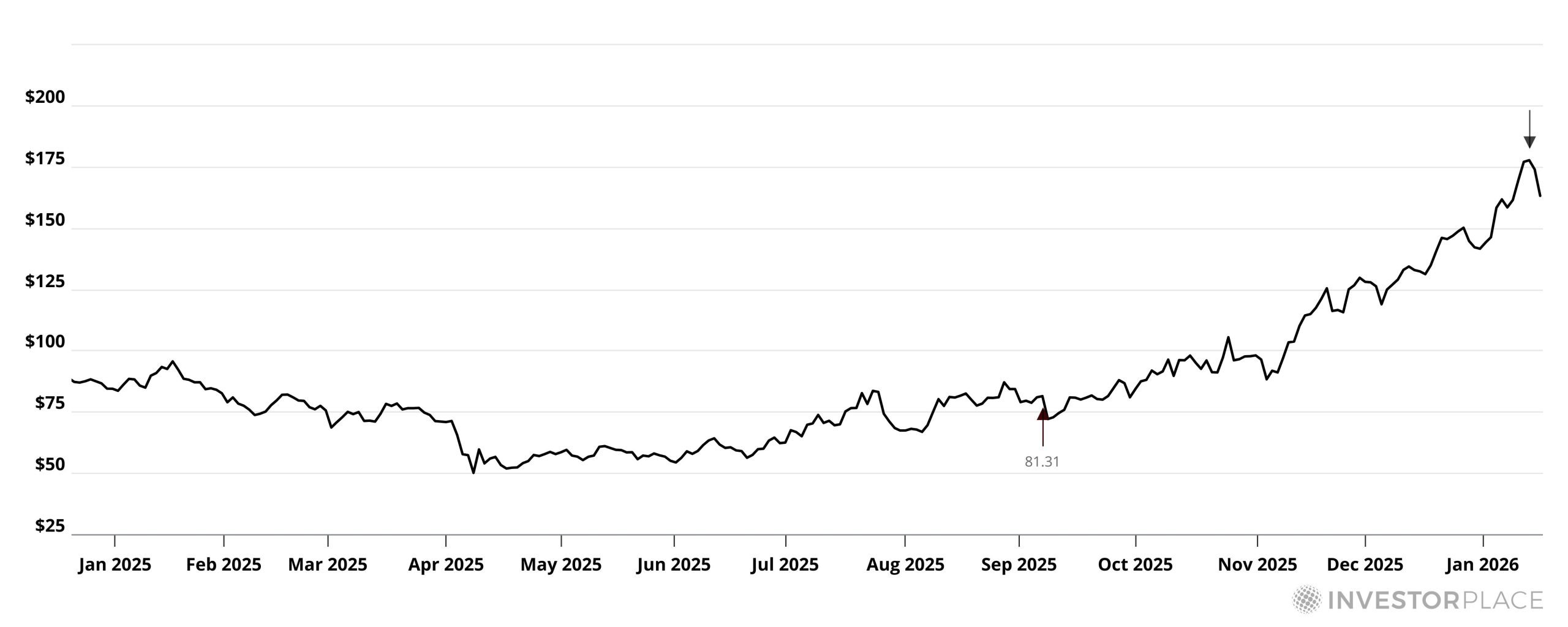

Nvidia (NASDAQ: NVDA) is currently trading at approximately $186 per share and has underperformed compared to the S&P 500 over the last three months. Despite recent updates presented at CES on January 5, 2026, including the launch of the Vera Rubin chip architecture, Nvidia’s stock has remained stagnant.

The Rubin architecture, designed for AI applications, marks a significant advancement over its predecessor, Blackwell. It features an integrated system comprised of six different chips and aims to improve efficiency by addressing AI workload bottlenecks, with anticipated shipping to customers in the second half of 2026. Nvidia demonstrated a five-fold increase in inference power and 3.5 times the training power compared to the Blackwell architecture.

Nvidia has been successful in maintaining high margins, converting approximately 70 cents of every dollar in sales into gross profit. As competition intensifies, the company’s continued innovations position it for robust growth, particularly with the launch of the Rubin platform expected to enhance its profitability in fiscal 2027.