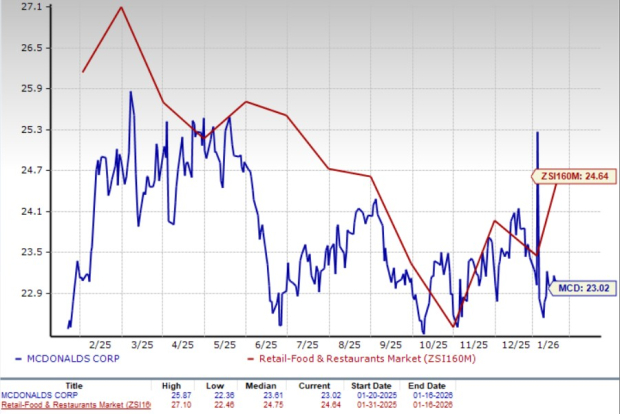

McDonald’s Corporation (MCD) is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 23.02, which is below the restaurant industry average of 24.64. Despite a 4% increase in its stock over the past six months, McDonald’s has underperformed the S&P 500’s 13% rally, raising questions regarding its valuation amidst broader consumer spending pressures.

In the third quarter of fiscal 2025, McDonald’s reported solid global comparable sales growth, aided by strong performance in key markets such as Germany, Australia, and Japan. However, management noted that lower-income consumers continue to reduce visits to quick-service restaurants, which could affect future demand. The company’s earnings forecasts for 2025 and 2026 have increased to $12.09 and $13.29 per share, respectively, with expected revenue of $26.68 billion and $28.26 billion, indicating year-over-year growth of 2.9% and 5.9%.

While McDonald’s maintains a strong operational model and ongoing growth initiatives, near-term macroeconomic pressures and rising input costs pose challenges to profitability. Current estimates suggest muted earnings growth until inflation stabilizes and traffic improves.