NIKE Inc. (NKE) is undergoing a turnaround as it confronts uneven global consumer demand and tightening discretionary spending. The company’s renewed strategy emphasizes sport-led innovation, targeting key segments such as Running, Basketball, and Football, in an effort to enhance product credibility and brand momentum. Investors are questioning whether NIKE’s innovative strategies can generate sufficient demand amid a challenging macroeconomic environment.

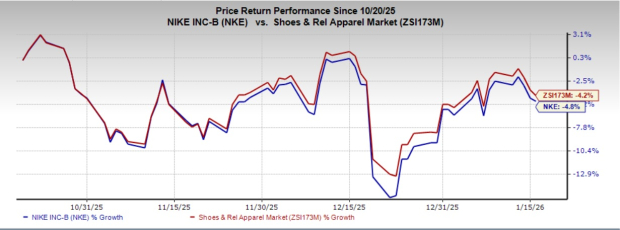

Key initiatives include accelerating innovation cycles and improving marketplace health, which are now showing positive early signs in North America with higher sales in performance footwear. However, NIKE faces challenges in Greater China and parts of Europe, where demand recovery is sluggish. The company experienced a 4.8% decline in shares over the past three months, compared to a 4.2% decline in the industry. The forward 12-month price-to-earnings ratio for NIKE is currently 30.82, higher than the industry average of 27.57.

According to Zacks Consensus Estimates, NIKE’s earnings are projected to decline by 28.2% in fiscal 2026 but are expected to rebound with a growth forecast of 54.2% for fiscal 2027. The company currently holds a Zacks Rank of #4 (Sell).