President Trump is engaged in contentious negotiations with Denmark regarding Greenland’s vast mineral resources, particularly its rare earth elements and uranium, crucial for the upcoming energy and AI sectors. This “Greenland Gambit” is seen as a high-stakes negotiation aiming to secure control over these critical resources, with Trump anticipated to leverage the scenario to break China’s dominance over the rare earth supply chain.

The negotiations come at a pivotal time, with the U.S. facing potential economic instability due to rising Treasury yields and a midterm election year, which heightens the urgency for a favorable outcome. Analysts suggest an 80-90% likelihood of a diplomatic resolution that allows U.S. access to Greenland’s Kvanefjeld deposit, located beneath its melting ice sheet, while maintaining Denmark’s sovereignty.

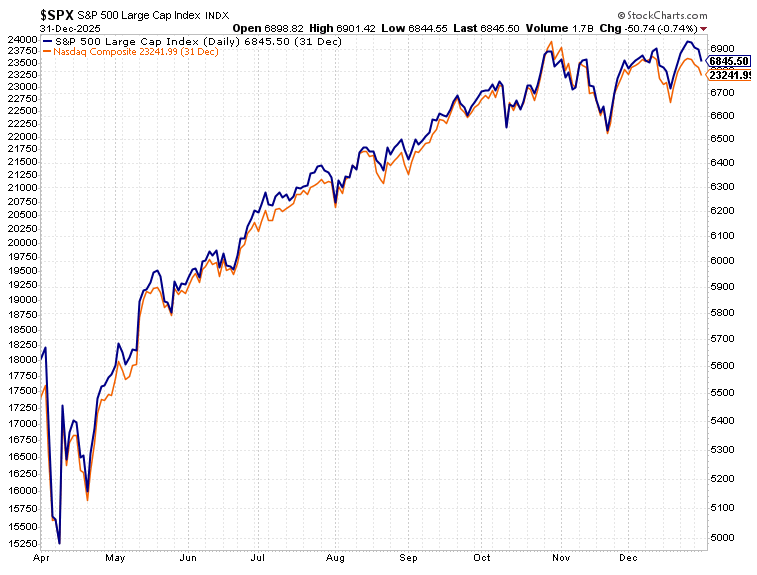

Key players include companies like Energy Fuels and MP Materials, which are positioned to capitalize on this deal, providing essential materials for the AI infrastructure. The overall market is expected to respond positively once a resolution is reached, potentially signaling a significant buying opportunity for investors in the relevant sectors. The relief rally could mirror past market recoveries, like the response to the 2025 “Liberation Day” tariff scare, which saw the S&P 500 gain about 30% shortly after an agreement was reached.