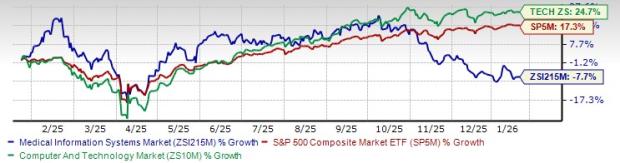

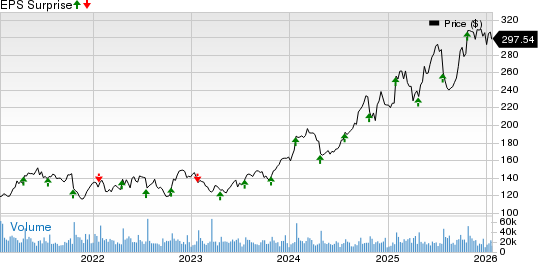

Lamb Weston Holdings (LW) reports a challenging earnings outlook, reflected in a Zacks Rank #5 (Strong Sell) as analysts express bearish sentiment. The company’s recent quarterly results revealed that EPS fell short of expectations by 37%, and sales were 5% below forecasts. This is the second consecutive quarter in which Lamb Weston has failed to meet both earnings and revenue expectations, pushing shares down to their lowest level since early 2022.

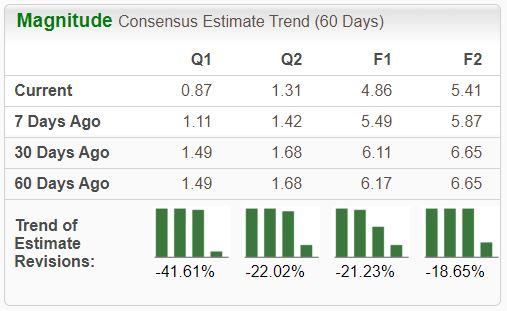

CEO Tom Werner cautioned that fiscal 2025 is expected to be another tough year due to softened demand stemming from menu price inflation affecting restaurant traffic globally. As a result, there has been an increase in available capacity in North America and Europe, further challenging the company’s performance amidst tightening consumer spending. Negative earnings estimate revisions suggest continued difficulties for Lamb Weston in the near term.